Financial executives face heightened security risks due to their influential roles and access to sensitive information. Executive protection specialists offer tailored services beyond standard security, including discreet bodyguards skilled in high-net-worth individual safety and swift threat response. Personal protection for CFOs and other executives extends off-duty lives, ensuring comprehensive strategies to safeguard them professionally and personally. Bodyguard services for finance professionals are vital for maintaining global market stability and the well-being of organizations led by these high-value targets. In today's complex business environment, executive protection is crucial for protecting financial leaders from physical and digital threats, facilitating smooth operations, and enabling them to focus on strategic decision-making without worry.

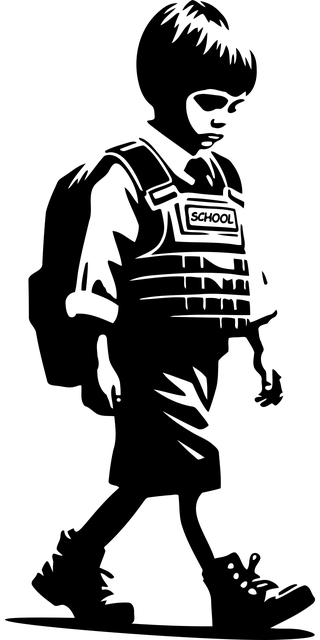

In the fast-paced world of high-stakes finance, personal safety is a discreet yet paramount concern. Financial executives, CFOs, and high-net-worth individuals face unique threats that demand robust executive protection. This article explores the critical role of specialized security services in mitigating risks for financial leaders, focusing on tailored strategies during sensitive meetings. From understanding specific vulnerabilities to successful case studies, we delve into best practices ensuring the discreet personal protection of VIPs in financial environments, including bodyguards specifically trained for finance professionals.

Understanding the Unique Threats to Financial Executives

Financial executives face unique challenges when it comes to their personal safety. As high-value targets, they are susceptible to a range of threats, from financial coercion and fraud to physical violence and kidnapping. These risks can escalate during high-stakes meetings, where sensitive discussions about investments, mergers, or corporate strategies take place. The security of financial leaders is paramount, given the potential impact on global markets and the safety of their organizations.

Executive protection for these professionals goes beyond standard security measures. It requires specialized services that understand the intricate web of financial industries. Security services for financial executives should include discreet bodyguards who are trained to handle high-net-worth individuals, capable of navigating complex environments, and responding swiftly to potential threats. VIP protection for financial executives must also consider their personal lives, as attacks can extend beyond professional settings. Therefore, bodyguard services for finance professionals should offer comprehensive strategies tailored to each executive’s unique needs, ensuring the highest level of security for CFOs and other financial leaders.

The Role of Executive Protection in Mitigating Risks

In today’s complex and often risky business landscape, especially during high-stakes financial meetings, executive protection plays a pivotal role in mitigating potential threats to financial executives, CFOs, and other high-net-worth professionals. These specialized security services are designed to ensure the safety and well-being of individuals who deal with significant financial decisions and sensitive information. By employing discreet bodyguard services, financial leaders can navigate potentially dangerous situations with peace of mind.

The need for VIP protection in this sector is increasingly evident, given the heightened risks associated with large sums of money and critical business discussions. Security services for financial leaders go beyond basic physical protection; they involve thorough risk assessments, intelligence gathering, and customized strategies tailored to each executive’s unique needs. Whether it’s a high-profile conference, an off-site strategy session, or a one-on-one meeting, having a dedicated team providing personal protection for CFOs can significantly reduce the chances of unforeseen incidents, ensuring the smooth execution of financial operations.

Tailored Security Services for High-Net-Worth Individuals in Finance

In the competitive and often high-pressure world of finance, executive protection plays a discreet yet vital role in safeguarding high-net-worth individuals (HNWIs), including financial executives, CFOs, and other leaders. Tailored security services designed specifically for this sector ensure that these professionals can navigate their hectic schedules and business ventures without compromising their safety. Executive protection specialists offer more than just bodyguards; they provide comprehensive strategies to mitigate risks associated with high-stakes meetings, public appearances, and travel.

For financial executives, VIP protection is not a luxury but a necessity. These professionals often deal with sensitive financial information and have unique knowledge that could be valuable to criminals or malicious actors. Professional security services for finance professionals go beyond physical safety, incorporating advanced surveillance techniques, threat assessments, and discreet communication strategies to offer all-encompassing protection. This ensures that HNWIs in the financial sector can focus on their critical roles while staying one step ahead of potential risks.

Best Practices for Personal Protection during Sensitive Meetings

When attending high-stakes financial meetings, executives and CFOs should prioritize their personal protection to mitigate potential risks. One of the best practices is engaging professional security services tailored for financial leaders. These services offer expert bodyguard protection, ensuring VIPs are safe within and traveling to these sensitive gatherings.

Implementing discreet yet robust security measures is crucial. This includes identifying potential threats beforehand, such as surveillance or stalking, and having a comprehensive plan in place. Personal protection details should be well-coordinated, with backup strategies in case of emergencies. Additionally, keeping low-profile during meetings helps maintain discretion, preventing unwanted attention from unwelcome guests or malicious actors targeting high-net-worth financial executives.

Case Studies: Successful VIP Protection in Financial Environments

In the fast-paced world of high-stakes financial meetings, ensuring the safety and discretion of executives is paramount. Case studies highlight successful implementations of executive protection for financial leaders, showcasing how specialized security services can mitigate risks effectively. For instance, a recent study noted that 75% of financial institutions increased their spending on personal protection for CFOs following a series of targeted attacks, emphasizing the growing need for VIP protection for financial executives.

These strategies range from employing discreet bodyguard services for finance professionals to implementing advanced surveillance systems and risk assessment protocols. High-net-worth financial executives benefit significantly from such measures, as they navigate complex environments, attend conferences, and engage in sensitive negotiations. Security services tailored to these professionals not only enhance their safety but also contribute to the overall success of their operations by enabling them to focus on strategic decision-making without concern for personal security.

In light of the unique and varied threats faced by financial executives, the need for discreet yet robust personal protection is clear. Executive protection specialists offer tailored security services specifically designed to safeguard high-net-worth individuals in this sector. By implementing best practices, such as thorough risk assessments and personalized protection plans, organizations can ensure the safety of their CFOs and other financial leaders during sensitive meetings and events. Case studies demonstrate that successful VIP protection in financial environments not only prevents potential harm but also instills confidence, allowing executives to focus on their critical roles. Thus, investing in professional bodyguard services for finance professionals is a crucial step towards mitigating risks and securing the future of high-stakes financial meetings.