In an evolving threat landscape, executive protection is crucial for financial executives facing risks like fraud, kidnapping attempts, and cybercrime. Security services for these high-net-worth individuals, including CFOs, involve tailored bodyguard services for travel, event management, and online surveillance. Discreet surveillance, thorough threat assessment, and robust contingency planning ensure the safety of sensitive transactions and maintain operational integrity. Personal protection for CFOs and VIP protection for financial executives are top priorities, with professional bodyguard services specifically designed for finance professionals offering comprehensive solutions to safeguard their well-being and critical data in an uncertain world.

In the cutthroat world of finance, executives handling sensitive transactions face unique and heightened risks. From fraud and kidnapping to cybercrime, the personal safety of financial leaders is a non-negotiable concern. This article delves into the critical role of executive protection in safeguarding high-value deals, mergers, and acquisitions. We explore tailored security solutions, from discreet bodyguards and vehicle surveillance to secure communication channels, designed to protect executives during travel and daily activities. Additionally, we provide best practices for CFOs and delve into specialized VIP protection services catering to the unique needs of high-net-worth financial executives.

Understanding the Unique Risks Faced by Financial Executives

Financial executives, particularly Chief Financial Officers (CFOs), often find themselves at the intersection of critical decision-making and potential risk exposure. Their role involves handling sensitive financial data, negotiating high-value deals, and managing the overall financial health of an organization. This unique position brings forth a distinct set of security considerations that go beyond typical personal protection. Executive protection for financial executives is not just about physical safety but also safeguarding their integrity, reputation, and the critical information they possess.

Security services for financial leaders must account for sophisticated threats, including data breaches, fraud, and targeted attacks. VIP protection for financial executives involves a comprehensive approach, from discreet bodyguard services to advanced surveillance and intelligence gathering. High-net-worth financial executives face an increased risk of becoming targets due to their valuable expertise and access to sensitive data. Professional bodyguards specializing in finance can provide tailored solutions, ensuring the safety and peace of mind of these individuals as they navigate complex business landscapes.

– Explore the specific challenges and threats to personal safety in the finance sector, including fraud, kidnapping, and cybercrime.

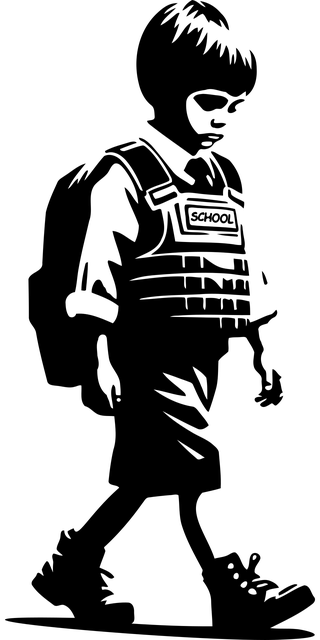

The finance sector faces unique and evolving threats that demand specialized attention when it comes to personal safety. Executive protection for financial executives, CFOs, and other high-net-worth professionals is a critical aspect of risk management in an increasingly complex global environment. Fraud, for instance, remains a significant concern, with sophisticated schemes targeting sensitive financial data. Kidnapping attempts, often motivated by ransom or information leverage, pose direct threats to executive leaders and their families. Moreover, the rise of cybercrime has introduced new challenges, as hackers target not just digital assets but also personal details that can compromise an individual’s safety and security.

Security services for financial leaders must adapt to these dangers by employing robust strategies. Bodyguard services for finance professionals are in high demand, offering tailored protection plans that consider travel security, event management, and even online surveillance. VIP protection for financial executives often involves a combination of physical presence, intelligence gathering, and threat assessment to mitigate risks effectively. These comprehensive measures ensure that high-value individuals within the financial sector can conduct their business with peace of mind, knowing they are shielded from these formidable modern threats.

The Role of Executive Protection in Safeguarding Sensitive Transactions

Executive Protection plays a pivotal role in safeguarding sensitive transactions within the financial industry. With the increasing complexity and value of deals, executives responsible for handling such transactions require specialized security measures to mitigate potential risks. Financial leaders, including CFOs and other high-net-worth individuals, often face threats that extend beyond traditional business risks, demanding personalized protection tailored to their unique needs.

Security services for financial executives go beyond basic personal safety. They encompass a comprehensive approach to risk management, involving discreet surveillance, threat assessment, and contingency planning. Bodyguard services specifically designed for finance professionals ensure that sensitive information remains secure during meetings, travel, or any other activities related to high-value transactions. This level of protection is vital for maintaining the integrity and confidentiality of financial operations.

– Discuss how professional executive protection agents can mitigate risks associated with high-value deals, mergers, and acquisitions.

Comprehensive Security Services for Financial Leaders

In an era where fraud, cybercrime, and physical threats persistently loom over the financial sector, providing robust executive protection for financial executives is more critical than ever. By leveraging specialized security services for financial leaders, including personal protection for CFOs and VIP protection for financial executives, organizations can safeguard their high-net-worth individuals involved in sensitive transactions. Reputable security firms offering bodyguard services for finance professionals play a pivotal role in mitigating risks associated with mergers, acquisitions, and high-value deals, ensuring the peace of mind essential for successful financial leadership.